North Carolina

Home > North Carolina

North Carolina

2023 Biennial Consolidated Carbon Plan and Integrated Resource Plans

Board Members, Dr. Jennifer Chen and R. Brent Alderfer and New Energy Economics Director Energy & Infrastructure, Ivan Urlaub

New Energy Economics’ objectives align with and help corporate consumer priorities of addressing market barriers to low-cost clean energy and meet carbon related goals:

- Decarbonize the grid.

- Access to more renewable energy.

- Increase energy efficiency.

- Retire uneconomic assets.

Together, with strategic partners, provide reliable, lower-cost clean energy for all utility customers.

NEE has engaged in North Carolina rules and planning process to clarify and mitigate price and reliability risks posed by Duke Energy’s intensifying dependence on natural gas power generation, transmission expansion, and lack of economically beneficial resource diversification and regional resource sharing. In 2023 NEE filed comments and improvements to Duke Energy’s proposed new Carbon Plan / Integrated Resource Plan Rule. In 2024, NEE’s testimony highlighted recommendations that will economically and reliably reduce Duke’s proposed reserve margin and accurately incorporate natural gas price risk and volatility into the planning and resource selection. NEE’s analysis and engagement has beneficial implications for improving Duke’s unnecessarily limited planning assumptions, offering customer programs that affordably meet customers’ changing needs, and reducing Duke’s cost of service while maintaining reliability.

2023 NCUC Carbon Plan / IRP Rulemaking

NEE Staff Consultant drafted filed comments with expert input from NEE Board member Ron Lehr regarding All Source Procurement principles and process.

NEE motioned to intervene, but was ojbected to by Duke Energy and ultimately denied by the Commission on basis NEE did not have standing. Regardless, NEE filed comments with its motion to intervene, ensuring that all parties would see the comments and have opportunity to support.

NEE Petition to Intervene Docket e-100, sub 191

NEE Comments on the Proposed Rule

Conclusions & Recommendations

∙ “These Comments focus on linking Duke’s resource planning processes to its procurement processes in a way that moves towards all-source procurement (“ASP”) for most or all resources approved in the CPIRP. Although at first glance ASP may seem inconsistent (or at least in tension with) North Carolina H.B. 951’s requirements as to resource and resource ownership, or with the approach to portfolio selection taken by the Commission in its Order Adopting Initial Carbon Plan and Providing Direction for Future Planning issued in docket no. E-100 Sub 179 December 30, 2022 (“Carbon Plan Order”), NEE submits that ASP can be employed to validate and refine the resource plans approved by the Commission in Carbon Plan / IRP proceedings, so that they conform to market realities and can achieve compliance with the carbon reduction mandates of H.B. 951 at the lowest cost for customers.”

∙ Provided evidence that All-Source Procurement benefits customers and can be effectively deployed in North Carolina

∙ Argued that competition, transparency, and feedback of using real bid prices in final planning decisions benefit customers and near-term procurement participants

∙ Recommended edits to the utility’s proposed IRP rule to accommodate ASP, including process efficiency, inclusion of a two-phase CPIRP process, integrating procurement into planning, ensuring bidders have sufficient confidence in the process to file competitive bids, that a stakeholder process occur to establish RFP elements and process, and that contracting and CPCN occur immediately following the end of the biennial planning cycle to ensure timely project execution of awarded bids.

Outcome

∙ Multiple parties supported NEE’s recommended integration of all source procurement into the final rule.

2023/24 Duke Carolinas & Duke Progress Carbon Plan / IRP

NEE Expert Witness testimony on behalf of CEBA by Board Members Jennie Chen and Brent Alderfer, NEE Staff Consultant Ivan Urlaub, and CEBA Senior Director, Government Affairs, Kyle Davis

NCUC Docket e-100, sub 190 – Redacted Testimony (all witnesses) & Confidential Testimony (Alderfer/Urlaub only)

“The purpose of my testimony is to comment on the 2023 Resource Adequacy Study for Duke Energy Carolinas & Duke Energy Progress (hereinafter, the Astrapé Study), which is the reserve margin study filed by Duke Energy Carolinas and Duke Energy Progress (collectively, the Companies or DEC/DEP) as Attachment I to its initial filing to support its target reserve margin proposal, and to provide some broader perspectives on reliability and customer costs.” -Dr. Chen

“Our conclusion is that the Plan would lock the Companies into natural gas generation for several decades longer than Duke represents, and past the 2050 carbon neutrality deadline of 2050 set forth in HB 951. The purpose of our testimony is to enumerate the significant risks and costs to ratepayers if Duke increases its reliance on natural gas for electric generation, as it has proposed to do. We describe the market forces and changing dynamics that will drive future natural gas prices and the volatility that will result in unavoidable runups and spikes in natural gas prices. We present examples of the magnitude of the costs to ratepayers from the runups and spikes that are inherent parts of natural gas supply markets, historically and going forward. Duke greatly underestimates resulting ratepayer costs in selecting a gas-heavy portfolio. The Commission should direct Duke in the near-term action plan to re-run its modeling using a more accurate representation of natural gas fuel cost and supply risk.

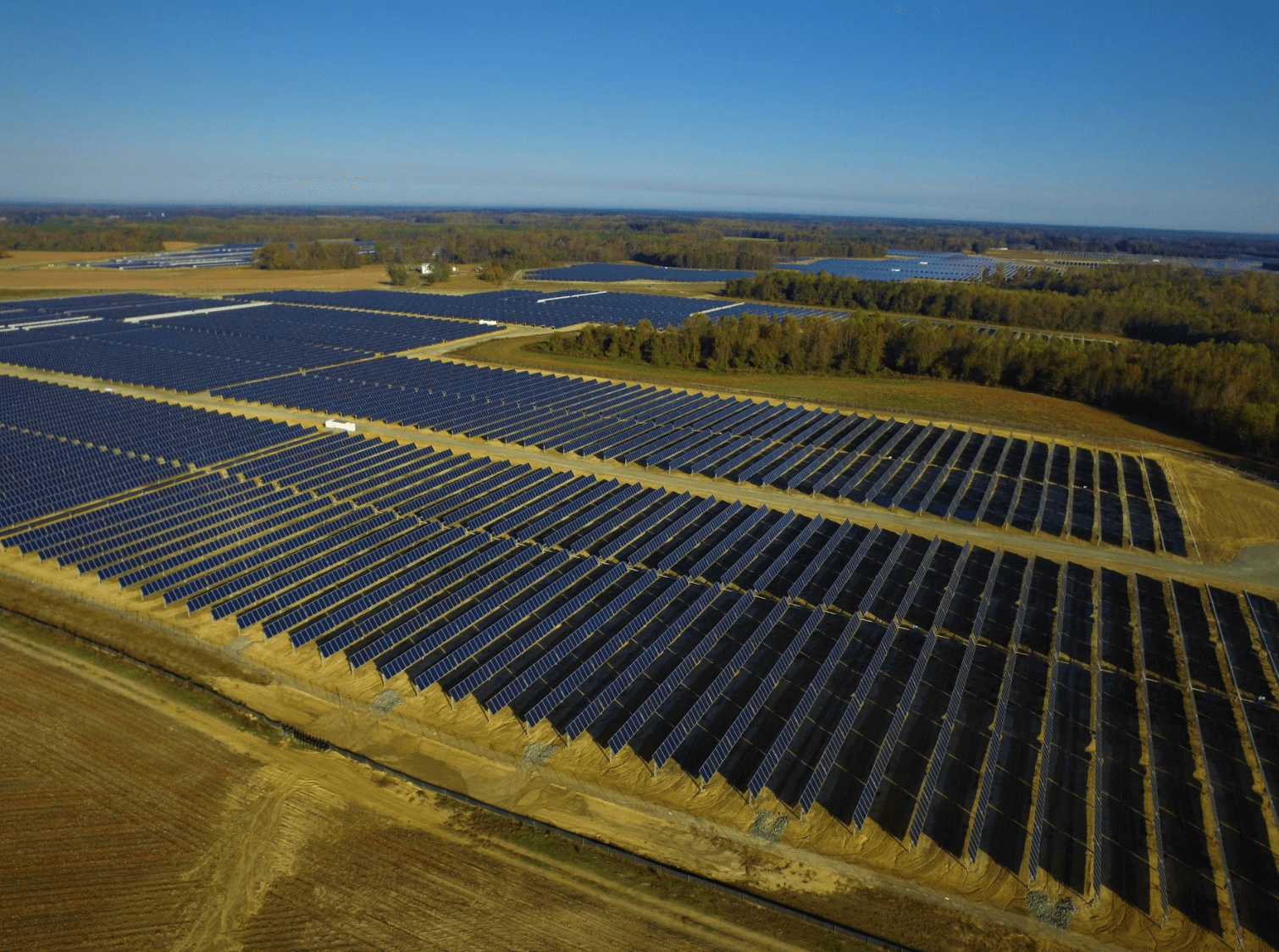

Accounting for the cost of gas price volatility makes it clear that the portfolios that best manage ratepayer costs and meet carbon reduction obligations include greater investment in fixed-price carbon-free resources, including solar, wind, battery storage, and demand-side resources. To mitigate cost-of-service and reliability risks, we urge earlier interconnection of fixed-cost carbon-free resources to meet the carbon goals in a least-cost manner and to minimize rate impacts to Duke ratepayers. This is particularly prudent and necessary in light of the load growth Duke describes from national onshoring policy, regional and state business expansion, and digital infrastructure growth.” -Alderfer & Urlaub

Conclusions and Recommendations

∙ Higher reserve margin proposed by Duke will not guarantee improved reliability

∙ Duke could improve reliability by improving near-term forecasting and planned outage scheduling, which would reduce the need for a reserve margin increase

∙ Duke should model regional resource sharing and the resource adequacy study failed to adequately consider regional resource sharing, which would considerably reduce the need to increase the reserve margin

∙ To ensure the gas risks and price volatility NEE documented is captured in the forward planning inputs and the resource selection for the preferred portfolio, Duke should either

o at a minimum use its High gas price forecast as its base case and then run a sensitivity for a new higher forecast that more accurately incorporates the historical cost of natural gas fuel price volatility, and/or

o obtain a long-term gas fuel hedge price for the useful life of its proposed gas generation capacity additions for use as a more accurate fuel price forecast.

∙ Duke should mitigate identified gas risks by diversifying further into fuel free resources like renewables and storage, build out its state and regional transmission system, offer additional EE and demand response programs, implement low cost and quicker to deploy grid enhancing technologies, and work with QFs to add additional capacity by extending QF contracts, uprating those QFs (the plan already uprates nuclear), and adding storage to those QFs instead of simply assuming they must be replaced with like-kind resources.

Outcomes

∙ Duke can only proceed with HALF of its proposed gas capacity additions AND must confirm in each upcoming gas plant CPCN that Duke will have firm fuel supply strategy in place.

∙ Multiple intervenors stated support for part or all of NEE’s natural gas risk and volatility testimony during the evidentiary hearing.

∙ Various parties have continued to work on the gas issues and solutions NEE offered in this case across multiple NCUC proceedings, such as carrying NEE’s gas risk and volatility issues, analysis, and recommendations forward into Duke Energy’s 2025 Fuel Clause proceeding.

2025/26 Duke Carolinas & Duke Progress Carbon Plan / IRP (NC) and

Carolinas Resource Plan (SC)

NEE has agreed to provide Expert Witness testimony on behalf of CEBA

About

New Energy Economics

We assist policy makers, utilities, and stakeholders in making informed energy decisions through non-partisan analysis within state regulatory arenas.

Join Now

Quick links

Contact Us

Phone:

(919) 801-3558

Address:

1121 Military Cutoff Road

Suite C #205

Wilmington, NC 28405

Copyright © 2025 New Energy Economics. All Rights Reserved.